What is Cost Plus Pricing?

Cost plus pricing is a pricing strategy businesses use to determine the selling price of a product. This pricing method involves calculating the cost of producing a unit of a product and then adding a predetermined markup or profit margin to arrive at the final price.

The fundamental concept behind cost plus pricing is relatively straightforward. To set a profitable price, businesses must first identify and quantify all the costs associated with producing or delivering their goods or services.

These costs typically include direct expenses such as raw materials, labor, manufacturing or production costs. It also takes into account indirect expenses like overhead costs, utilities, rent, and administrative expenses.

After evaluating the costs, the next step is to incorporate a profit margin into the pricing equation. The profit margin represents the additional amount added to the total cost, allowing the business to generate a reasonable profit on each unit sold.

The profit margin can be either a fixed percentage or a specific amount. Most retailers and small businesses target an average markup percentage of 50 percent.

Here, the markup does not take into account some external factors such as customer demand or competitor prices, making this pricing strategy inefficient for SaaS products. It bases a business’s pricing strategy on operational costs without considering how much value you provide to your customers.

The subscription SaaS business model, on the other hand, considers how much value each customer needs and how much they are willing to pay for it. This gives you the flexibility to offer a variety of plans at different price points. You’re also able to set price points based on demand and market trends.

If a business incorporates a cost plus pricing strategy for software solutions, they run the risk of not gaining optimal profit from the value their solution provides or selling overpriced products.

For SaaS, we recommend more compatible pricing strategies such as value based pricing, price anchoring, and tiered pricing strategy.

This comprehensive guide explores the intricacies of cost plus pricing. You’ll learn how to calculate cost plus pricing, how to use it to increase your business revenue, and why we believe it’s not a compatible pricing strategy for SaaS.

Cost Plus Pricing Example

Here’s a simple way to calculate cost plus pricing. Let’s consider a company that manufactures and sells custom-made furniture. The company wants to determine the selling price for a dining table that it produces. Here are the cost details for manufacturing the table:

- Direct Materials Cost: $200 (cost of wood, screws, varnish, etc.)

- Direct Labor Cost: $100 (wages of workers involved in manufacturing the table)

- Overhead Costs: $50 (includes utilities, rent, maintenance, etc.)

- Desired Profit Margin: 50% of total cost

To calculate the selling price using cost plus pricing, the company will add the desired profit margin to the total cost. Let’s calculate the total cost first:

- Total Cost = Direct Materials Cost + Direct Labor Cost + Overhead Costs

Total Cost = $200 + $100 + $50

Total Cost = $350

Now, let’s calculate the markup amount by applying the desired profit margin:

- Markup = Desired Profit Margin x Total Cost

Markup = 0.50 * $350

Markup = $175

Finally, the cost plus pricing formula, the selling price will be the total cost plus the markup:

- Selling Price = Total Cost + Markup

Selling Price = $350 + $175

Selling Price = $525

So, using cost plus pricing, the company would set the selling price of the dining table at $525. This price will cover the production cost and provide the desired profit margin of 50%.

When to Use Cost Plus Pricing

Cost plus pricing works best in specific industries. Here are four popular situations to use this pricing strategy :

1. Cost-Driven Industries

In industries like manufacturing, construction, or consulting, costs often account for a substantial portion of the overall pricing. Using a cost plus pricing approach in such industries ensures that all the necessary resources, expertise, and efforts involved in delivering complex offerings are adequately accounted for, ensuring fair compensation for the value provided.

2. Long-Term Contracts

Long-term contracts or government contracts often require transparency in cost breakdowns and the justification of expenses. Cost plus pricing provides a clear and transparent method for determining the selling price by incorporating all relevant costs. This transparency helps build trust and facilitates effective contract management.

When Cost Plus Pricing Doesn’t Work

While cost plus pricing can be effective in some situations, there are instances where it may not be the most suitable approach. Here are some scenarios where cost plus pricing may not work well:

1. Competitive Market

In highly competitive markets where customers have multiple options and pricing is a key differentiating factor, cost plus pricing may not be the best strategy. If a product appears overpriced compared to competitors, customers are more likely to prioritize lower prices over cost transparency. It’s advisable to consider what the market is willing to pay when setting your product prices.

2. Unique Selling Point

If a company offers products or services with a unique value proposition, cost plus pricing may not adequately capture the value provided.

For example, Apple is widely recognized for its innovation and luxury; therefore, pricing based solely on costs may fail to reflect the premium customers are willing to pay for unique features, innovation, or superior quality. In this case, a psychological pricing strategy like prestige pricing may be more appropriate.

MORE: Charm pricing explained with examples.

Pros and Cons of Cost Plus Pricing

Cost plus pricing offers several advantages for businesses. At the same time, it comes with potential drawbacks you must consider, here are some pros and cons of cost plus pricing.

Pros of Cost Plus Pricing

- Cost Recovery

Cost plus pricing ensures that businesses can recover their costs and achieve profitability. They calculate all the costs involved and use that information to set the price, making sure that every sale helps cover their expenses. It’s an efficient way to minimize the risk of losing money and keeping the business running smoothly.

- Cost Transparency

Cost plus pricing provides transparency to customers by offering a clear breakdown of costs. This transparency can build trust and credibility with customers, as they can see how the selling price is determined based on the actual costs incurred by the business.

- Simplicity and Ease of Implementation

Cost plus pricing is pretty straightforward to use compared to other pricing methods. All you have to do is figure out your costs, add a fair profit margin, and set the selling price. It’s a simple way for businesses to determine their prices without needing to do a ton of market research or use complicated pricing models.

- Cost Control and Efficiency

Cost plus pricing encourages businesses to closely monitor and control their costs. By tracking costs and regularly reviewing them, businesses can identify areas of inefficiency, reduce wastage, and improve operational effectiveness.

MORE: Decoy pricing explained with examples.

Cons of Cost Pricing

- Limited Pricing Flexibility

Cost plus pricing model is based on the assumption that there is a fixed cost for each product or service. Whereas, this may be incorrect if there are seasonal fluctuations in demand, market trends, and competitive prices. If market prices drop or costs start fluctuating, businesses that use cost plus pricing might struggle to adjust their prices quickly enough to stay competitive and keep making profits.

- Potential Lack of Pricing Efficiency

With cost plus pricing, businesses may not feel motivated to optimize their costs and operational efficiencies. Since the selling price is mostly determined by the costs incurred, there’s less focus on controlling expenses and working smarter. This approach can make it harder to reduce expenses, boost productivity, or innovate processes to enhance competitiveness.

- Potential Inadequate Profitability

While cost plus pricing ensures cost recovery, it may not always result in optimal profitability. This is because it disregards the importance of customer value. It is essential for businesses to understand the willingness of customers, so that they can price their products appropriately and successfully sell them.

Key Considerations for Product Pricing

To implement a more accurate pricing strategy in a business, there are several key considerations you should take into account. These include:

1. Cost Accuracy and Allocation

Ensure that you have a clear understanding of all direct and indirect costs associated with your product. Implementing robust cost accounting systems can help you track and allocate costs accurately.

For example, Freshbooks offers a markup calculator to help add up the true cost of your products. Proper cost allocation ensures that all expenses are accounted for and appropriately included in the cost plus pricing formula.

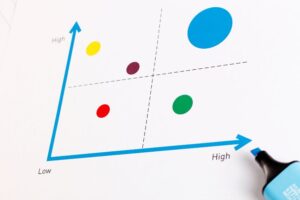

2. Market Dynamics

Observe what’s happening in the market and how your competitors are doing. Are customers in your target market focused on getting the best price, or do they care more about things like quality, brand reputation, or cool features?

Understanding what customers value the most will help you figure out if cost plus pricing is a good fit for meeting their expectations and dealing with the competition out there.

3. Customer Value Perception

Think about the unique features, benefits, or solutions your offering provides. While cost plus pricing relies on cost recovery, it’s crucial to align the pricing with the value customers perceive. If customers believe the product or service provides unique features, superior quality, or other value-added benefits, the pricing should reflect that value proposition.

For more guidance on key factors that determine how consumers view product pricing, read our psychological pricing article.

4. Compliance and Contractual Requirements

If you operate in industries or have contractual agreements that require cost plus pricing, ensure that you fully understand and comply with any regulatory or contractual obligation.

Compliance may include keeping accurate cost reporting, maintaining auditable records, and sticking to any guidelines or standards laid out in your contracts or agreements. It’s all about playing by the rules and making sure everything is above board.

Key Takeaways

- Cost plus pricing is just one way to set your prices, and it might not cover all the things you need to think about.

- Remember to also consider what’s happening in the market, what customers really want, and how your competitors are pricing their products.

- Keeping an eye on all these factors will help you come up with the right selling price.

Related Posts

Frequently Asked Questions (FAQ)

Author

Methodology

- Who?

We are SaaS experts: Our specialists constantly seek the most relevant information to help support your SaaS business. - Why?

We are passionate about users accessing fair SaaS pricing: We offer up-to-date pricing data, reviews, new tools, blogs and research to help you make informed SaaS pricing decisions. - How?

With accurate information: Our website manager tests each software to add a Genius Score using our rating methodology to each product. Our editorial team fact-check every piece of content we publish, and we use first-hand testing, value metrics and leading market data.