What is Charm Pricing?

Charm Pricing is a proven marketing tactic that involves setting prices for products or services slightly below round numbers in order to make them appear more appealing to consumers. It’s similar to odd even pricing strategy, but applied differently.

Charm pricing increases client interest and sales by instilling the perception of a good deal. It is a deliberate pricing method that uses consumer psychology to influence purchasing decisions.

Imagine you’re at a grand fair with bustling stalls. You come across two similar stores selling enchanted apples. The first store offers them at a flat $10 each, while the second store displays a price tag of $9.95. Intriguingly, the majority of the customers flock towards the second store. Why? This is the charm pricing effect in action.

The human mind perceives $9.95 to be significantly cheaper than $10. This seemingly small difference can have a substantial impact on purchasing decisions.

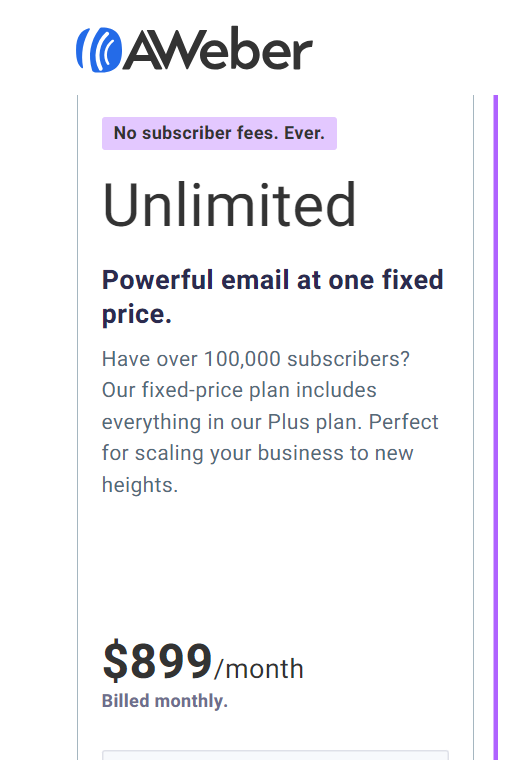

AWeber is an example of email marketing solutions utilizing this pricing strategy with unlimited plan pricing placed at $899.

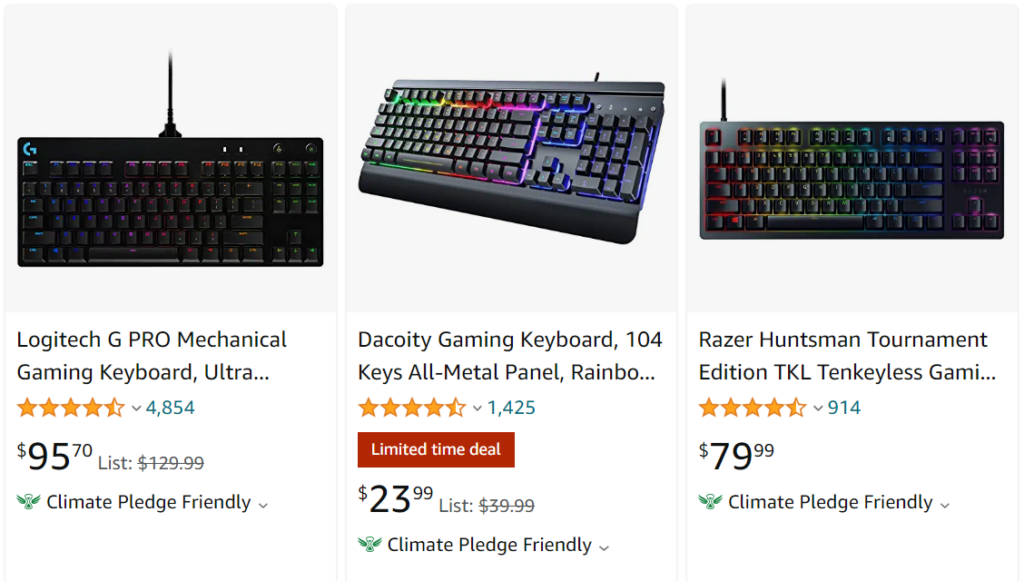

Retailing companies like Amazon frequently use charm pricing to encourage quick purchasing decisions.

How Charm Pricing Casts Its Spell

When people read from left to right, they see the first number and make an immediate association about the price range. This process is called the ‘left-digit effect,’ and it happens faster than you can say ‘Abracadabra.’

Seeing ‘19’ instead of ‘20’ makes a world of difference to our brains, leading us to think that the product is cheaper than it actually is.

Imagine you’re buying a laptop. Two options stand before you: one priced at $999.99 and the other at $1000.00. Instinctively, you feel the $999.99 laptop is much cheaper, even though the difference is merely a penny. This is charm pricing at work.

MORE: What is psychological pricing?

Why Does Charm Pricing Work

Creating a Perceived Value

Charm pricing gives consumers the impression of added value.

Even though the actual difference is only one cent, consumers frequently perceive the charm-priced product as more valuable as a result of the reduced pricing.

MORE: What is value-based pricing?

The Left-Digit Bias

The second secret ingredient in the charm pricing formula is related to how our brains process numbers.

The Left-Digit Effect states that we subconsciously value a price’s digit on the far left. As a result, when we see a price like $19.99, we mentally classify it as closer to $19 rather than $20.

Charm pricing works because we are hardwired to interpret it as a significant savings.

Creating a Perception of Affordability and Savings

Charm pricing conveys a sense of affordability. It’s not just about a product being cheaper; it’s also about it appearing cheaper.

For example, a customer might chose to go for the $39 Honeybook CRM solution when placed side by side with the Keap CRM priced t $40.

A $19.99 price tag gives the impression that the item is in the ‘teen’ dollar range rather than the ‘twenty’ dollar range. This seemingly minor change can significantly impact our perception of cost.

MORE: How Do Trial Pricing Strategies Work?

When and Where Is the Best Time To Use Charm Pricing?

Charm pricing works best in markets with fierce price competition and frequent, quick decisions by customers. It works especially well for lower-cost items where even a small price reduction can appear significant.

Strategic timing plays a pivotal role in leveraging charm pricing. When introducing a new product or service, use charm pricing to attract early adopters. Additionally, seasonal sales and promotional campaigns are also great times to use charm pricing.

MORE: What is cost plus pricing?

Does Charm Pricing Apply Online?

Charm pricing is entirely dependent on human perceptions. People frequently believe that $9.99 is significantly less expensive than $10.00, despite the fact that they are only a penny apart. This happens both in physical stores and online.

A good example of charm pricing in the online space can be found with Amazon retail shops. Since there are lots of similar products for buyers to pick from, most vendors utilize the charm pricing so their products can appear cheaper for its value.

However, while charm pricing appears to work in the SaaS market, it is not a fix. Its effectiveness is greatly determined by your target demographic, the perceived value of your service, and overall market positioning.

For example, if a company portrays itself as a premium, high-value solution, employing charm pricing may dilute the perceived quality of the service.

Keep in mind that cost is only one aspect of your product. A charm price may initially attract clients, but giving constant value is the key to retaining them.

Additionally, the SaaS model typically includes recurring payments. So, even a few pennies a month difference might add up to big savings for a consumer over time.

Implementing Charm Pricing in Your Business

The business world is becoming increasingly competitive, and having an advantage over your competitors can mean the difference between success and failure.

Charm pricing is a subtle but effective strategy for boosting your business. But how can you incorporate it into your pricing strategies effectively? Here are some useful hints and insights to help you.

Tips on Incorporating Charm Pricing Into Your Strategy

1. Understand Your Customer Base

Not all customers respond to charm pricing the same way. For example, younger demographics may be less sensitive to a $9.99 price tag than older demographics because they mentally round up the price.

Understand your customer base to ensure your charm pricing appeals to them.

2. Apply It Across the Board

Once you’ve decided to use charm pricing, use it consistently across your product line.

Customers will begin to associate your brand with affordability, which will encourage more purchases.

3. Combine It with Discounts

Display the original price with a slash next to the charm price. This not only increases the customer’s perception of receiving a good deal, but it also helps identify your brand as customer-centric.

MORE: High-low pricing strategy explained

4. Testing and Analyzing Results

Charm pricing, like all marketing strategies, must be tested and analyzed. Begin with A/B testing, where you offer the same product at both a rounded price and a charm price, then compare how well each performs.

Use customer surveys or feedback to determine whether customers consider the charm prices more affordable.

Keep an eye on your sales figures at all times. You’re on the right track if you notice a significant increase in sales after implementing charm pricing.

Remember that while charm pricing can be useful, it is not a one-size-fits-all solution.

Analyzing your results and adjusting your strategy as needed is critical for optimizing the charm pricing model for your company.

Pros and Cons of Charm Pricing

| Pros of Charm Pricing | Cons of Charm Pricing |

|---|---|

| Can help boost sales by making products seem cheaper. | Overuse of charm pricing can dilute its impact. |

| Appeals to the customers’ psychology, making them believe they’re getting a bargain, thus stimulating impulsive buying behavior. | Can sometimes be seen as deceptive, potentially damaging a brand’s reputation for honesty and transparency. |

| Gives businesses an edge over competitors who use rounded pricing. | Charm pricing could squeeze profit margins, particularly if the costs of production or service provision are high. |

| Odd prices like $9.99 or $19.95 tend to stick in customers’ minds more than rounded numbers, improving price recall. | Charm pricing in luxury or premium markets may communicate the wrong message about the brand’s quality and exclusivity. |

Key Takeaways

Charm pricing is a small yet powerful tool in the marketer’s arsenal, leveraging the idea that the first digit seen by consumers heavily influences their purchasing decisions.

Research supports the efficacy of this strategy in enhancing sales. However, businesses should use it thoughtfully, considering their brand positioning and customer expectations.

Overuse or misuse could lead to perceptions of lower quality or value. Therefore, understanding your market and aligning charm pricing with other pricing and marketing strategies is crucial for its successful application.

As with any business technique, it demands a balanced approach to yield the best results. The simplicity and effectiveness of the charm pricing strategy prove its enduring allure in the world of commerce.

For more pricing information to help guide your business, visit our SaaS Pricing pages.

Related Posts

Frequently Asked Questions (FAQ)

Author

Methodology

- Who?

We are SaaS experts: Our specialists constantly seek the most relevant information to help support your SaaS business. - Why?

We are passionate about users accessing fair SaaS pricing: We offer up-to-date pricing data, reviews, new tools, blogs and research to help you make informed SaaS pricing decisions. - How?

With accurate information: Our website manager tests each software to add a Genius Score using our rating methodology to each product. Our editorial team fact-check every piece of content we publish, and we use first-hand testing, value metrics and leading market data.