Starting and scaling a business requires laser focus on what matters most—building your product, serving customers, and driving growth. Yet entrepreneurs spend countless hours wrestling with spreadsheets, chasing invoices, and scrambling through receipts come tax time. The right accounting software transforms this financial chaos into streamlined clarity, giving you back precious time to focus on what you do best.

With 82% of startup failures linked to cash flow problems, choosing the right accounting software isn’t just about convenience—it’s about survival. This comprehensive guide cuts through the noise to help you find the perfect financial management solution for your entrepreneurial journey.

Comparing Top Accounting Software

| Software | Starting Price | Trial/Free Option | |

|---|---|---|---|

| Sage Accounting | £18/month | 3-month free trial | Start Free Trial |

| QuickBooks Online | $30/month | Standard trial | Try QuickBooks |

| Xero | $15/month | Standard trial | Get Started |

| FreshBooks | $19/month | Standard trial | Try Free |

| Wave | Free | Always free | Sign up Free |

| Zoho Books | $15/month | Standard trial | Try Zoho Books |

Why Entrepreneurs Need Specialized Accounting Software

The Unique Financial Challenges Entrepreneurs Face

Unlike established businesses with dedicated finance teams, entrepreneurs juggle multiple roles while managing complex financial needs. You’re simultaneously the CEO, product developer, marketer—and often, the reluctant accountant. Traditional bookkeeping methods simply don’t scale with the speed and agility modern entrepreneurs require.

Modern accounting software automates critical financial tasks, reducing human error and freeing you up to focus on scaling your business. Whether you’re tracking project profitability, managing international clients, or preparing for investor meetings, the right tools make the difference between thriving and merely surviving.

Key Benefits That Drive Business Growth

Time Savings That Compound: By automating invoice generation, expense categorization, and bank reconciliation, entrepreneurs reclaim hours each week. Many entrepreneurs report saving at least 2 days every month on billing tasks alone.

Real-Time Financial Intelligence: Dashboard views and instant reports transform raw data into actionable insights. You’ll spot cash flow issues before they become crises and identify profitable opportunities as they emerge.

Professional Credibility: Polished invoices, organized expense reports, and accurate financial statements signal to clients, partners, and investors that you run a serious operation—even if you’re working from your kitchen table.

Seamless Tax Compliance: With transactions automatically categorized and reports generated at the click of a button, tax season transforms from a nightmare into a manageable process.

Main Features Every Entrepreneur Should Demand

Core Accounting Functionality

The foundation of any good accounting software includes automated transaction categorization, real-time bank reconciliation, and comprehensive financial reporting. Look for platforms that handle these basics effortlessly while offering room to grow.

Intelligent Automation: AI-powered categorization learns from your patterns, accurately sorting 90-95% of transactions without manual input. This isn’t just convenient—it’s transformative for maintaining accurate books while focusing on growth.

Multi-Currency Support: Even if you’re currently domestic-only, the ability to handle international transactions positions you for global expansion. The best platforms seamlessly convert currencies and comply with international accounting standards.

Integration Ecosystem

Your accounting software shouldn’t exist in isolation. Native integrations reduce manual data entry, minimize errors, and provide a more comprehensive view of your financial health. Essential integrations include:

- Payment Processors: Stripe, PayPal, Square

- E-commerce Platforms: Shopify, WooCommerce, Amazon

- CRM Systems: Salesforce, HubSpot, Pipedrive

- Project Management: Asana, Trello, Monday.com

- Payroll Services: Gusto, ADP, Paychex

Mobile Accessibility

Entrepreneurs don’t work 9-to-5 from a desk. Whether you’re meeting clients, traveling to conferences, or working from a café, mobile access isn’t optional—it’s essential. Look for apps that offer full functionality, not just viewing capabilities.

Scalability Architecture

As your startup grows, your financial needs will continue to evolve, which is why it’s important to find an accounting system that can scale with you. Consider platforms that offer:

- Multiple user access with role-based permissions

- Advanced reporting as complexity increases

- API access for custom integrations

- Smooth migration paths to enterprise solutions

Top Accounting Software Solutions for Entrepreneurs in 2025

Sage Accounting: The Complete Entrepreneurial Solution

After extensive testing and analysis, Sage Accounting emerges as our top recommendation for entrepreneurs in 2025. This cloud-based powerhouse combines enterprise-grade capabilities with surprising ease of use, making it the ideal choice for ambitious entrepreneurs who refuse to compromise on functionality or user experience.

Why Sage Accounting Stands Above the Rest:

Sage uniquely understands the entrepreneurial journey. Unlike solutions that force you to upgrade as you grow, Sage provides advanced features from day one—at a price point that respects your bootstrap budget. The platform’s intelligent automation handles complex workflows while maintaining the simplicity entrepreneurs need.

Standout Features for Entrepreneurs:

- Smart Automation: Automated bank reconciliation and AI-driven insights that learn your business patterns.

- Comprehensive Inventory Management: Track stock levels, manage suppliers, and optimize cash flow—critical for product-based businesses.

- Multi-Currency Excellence: Seamlessly handle international transactions with real-time exchange rates.

- Advanced Reporting Suite: Financial forecasting, cash flow predictions, and customizable dashboards.

- Collaborative Tools: Real-time access for team members and accountants from any location.

- Mobile-First Design: Full functionality on mobile devices, not just viewing capabilities.

Pricing: Starting at £18/month with a generous 3-month free trial.

Best For: Growth-focused entrepreneurs who want professional-grade accounting tools without the enterprise complexity. Particularly excellent for businesses managing inventory or working with international clients.

Discover why Sage Accounting is revolutionizing financial management for entrepreneurs.

QuickBooks Online: The Established Choice

While QuickBooks Online remains a popular option with its extensive feature set and market presence, it can feel overwhelming for entrepreneurs who need streamlined simplicity. The platform offers robust functionality but often requires a steeper learning curve compared to more modern alternatives like Sage.

Key Features:

- Extensive third-party integrations (750+)

- Comprehensive reporting options

- Strong accountant network

- Industry-specific versions

Pricing: Starting at $30/month.

Best For: Entrepreneurs with complex integration needs or those working with accountants already familiar with QuickBooks.

Compare QuickBooks with Sage and other solutions on our comprehensive accounting software comparison page.

Xero: The Collaboration Tool

Xero offers strong collaborative features and unlimited users, but lacks the comprehensive inventory management and advanced automation that Sage provides. While its interface is modern, entrepreneurs often find they need additional apps to match Sage’s built-in functionality.

Standout Features for Entrepreneurs:

- Unlimited users on all plans

- Beautiful, intuitive interface

- Strong multi-currency support

- Excellent cash flow forecasting tools

Pricing: Starting at $15/month.

Best For: Entrepreneurs working with remote teams or international clients who prioritize user experience and collaboration.

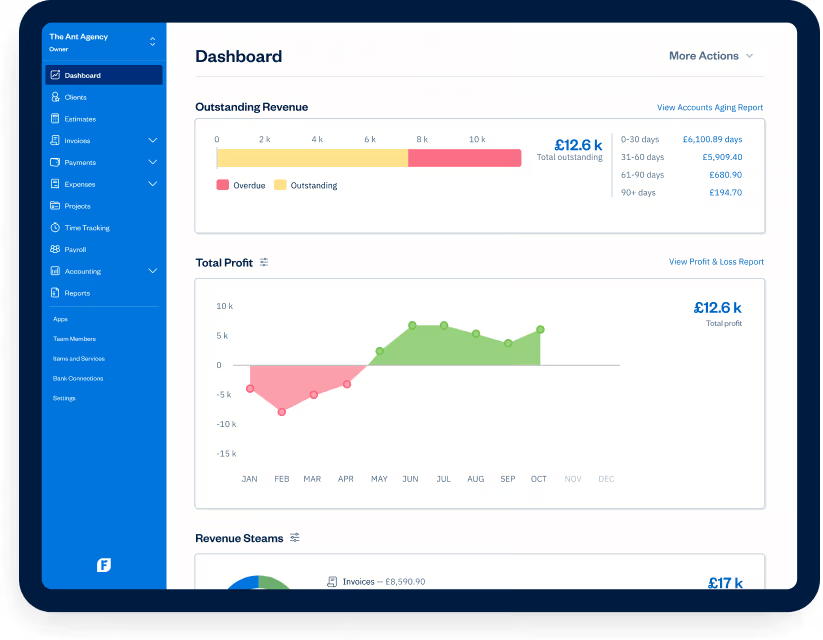

FreshBooks: Limited but Simple

FreshBooks works well for basic service businesses but quickly shows limitations as your business grows. Unlike Sage’s comprehensive approach, FreshBooks requires upgrading or switching platforms when you need advanced features like inventory tracking or multi-currency support.

Standout Features for Entrepreneurs:

- Intuitive time tracking that converts to invoices

- Automated payment reminders

- Project profitability tracking

- Client portal for seamless communication

Pricing: Starting at $19/month.

Best For: Consultants, freelancers, and service providers who bill by the hour and want minimal accounting complexity.

Read our detailed FreshBooks review to see if it’s right for your business.

Wave: Free but Feature-Limited

While Wave’s free pricing attracts bootstrapped startups, you often get what you pay for. The platform lacks the advanced features, customer support, and scalability that growing businesses need. Entrepreneurs frequently outgrow Wave within their first year, making Sage’s affordable pricing a better long-term investment.

Standout Features for Entrepreneurs:

- Completely free core accounting

- Clean, modern interface

- Built-in payment processing

- Basic financial reporting

Pricing: Free (payment processing fees apply)

Best For: Solopreneurs and early-stage startups operating on minimal budgets who need basic accounting functionality.

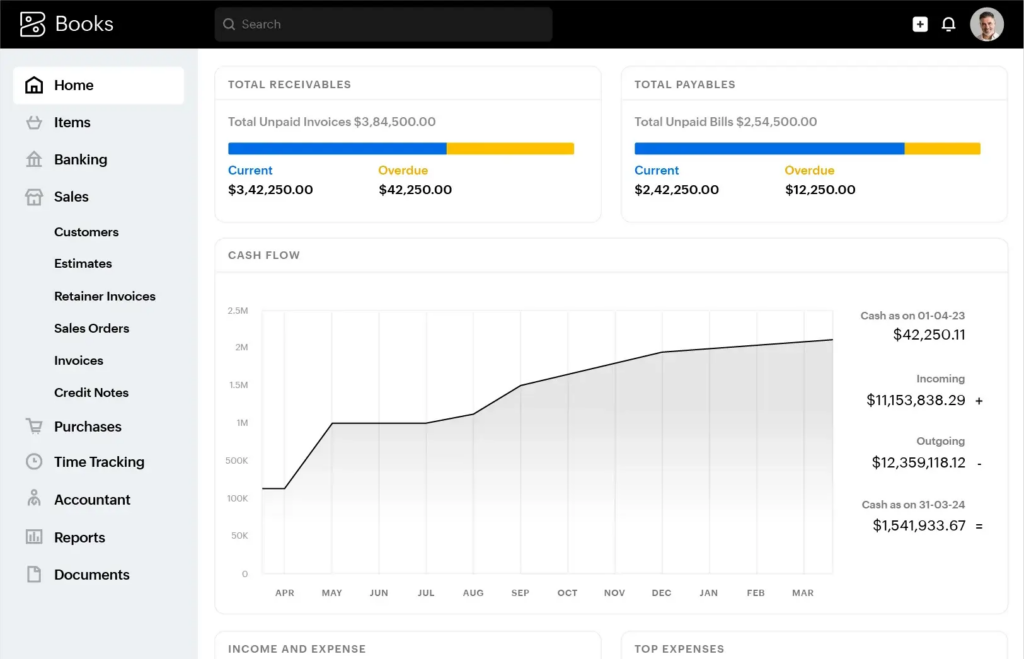

Zoho Books: The Ecosystem Player

Part of the comprehensive Zoho suite, Zoho Books is great for online entrepreneurs who already use other Zoho tools. Its tight integration with CRM, project management, and other Zoho apps creates a unified business management platform.

Standout Features for Entrepreneurs:

- Seamless Zoho ecosystem integration

- Workflow automation

- Multi-currency handling

- Competitive pricing

Pricing: Starting at $15/month.

Best For: Entrepreneurs already invested in the Zoho ecosystem or those seeking an all-in-one business platform.

Emerging Solutions Worth Watching

Puzzle: This AI-powered platform shows promise with automated categorization, though it lacks Sage’s maturity and comprehensive feature set. Learn more about Puzzle in our detailed review.

Brex: Combines expense management with accounting, but the integrated approach can be limiting compared to Sage’s flexibility and broader functionality.

Why Sage Accounting Wins for Entrepreneurs

After rigorous testing and comparison, Sage Accounting consistently delivers the best combination of power, simplicity, and value for entrepreneurs. Here’s why it’s our top recommendation:

1. Future-Proof Your Business: Unlike competitors that require platform switches as you grow, Sage scales seamlessly from solopreneur to established business.

2. True All-in-One Solution: While others require expensive add-ons for inventory, multi-currency, or advanced reporting, Sage includes these features in its core offering.

3. Exceptional Value: The 3-month free trial and competitive pricing make Sage accessible to bootstrapped startups while delivering enterprise-grade capabilities.

4. Global Ready: Built for the modern entrepreneur, Sage handles international business complexities that become roadblocks on other platforms.

5. Learning Curve That Pays Off: Sage’s intuitive interface means you’ll be productive quickly, while its depth ensures you won’t outgrow it.

Making the Right Choice: A Strategic Framework

Assess Your Current Needs

Start by mapping your immediate requirements:

- Transaction volume and complexity

- Number of clients and invoices

- International operations

- Team size and collaboration needs

- Integration requirements.

Plan for Future Growth

Consider both your current and future needs, like handling multi-currency transactions, managing payroll for a growing team, or providing advanced reporting for potential investors. Choose software that won’t constrain your ambitions.

Calculate True ROI

Look beyond monthly subscription costs. Factor in:

- Time saved on manual tasks

- Reduced error rates and their financial impact

- Professional appearance to clients

- Stress reduction during tax season

- Opportunity cost of delayed financial insights.

Test Before Committing

Most platforms offer free trials—use them strategically:

- Import real data to test accuracy

- Complete a full invoicing cycle

- Generate key reports you’ll need

- Test mobile functionality

- Evaluate customer support responsiveness.

Implementation Best Practices

Start With Clean Data

Before migrating to new software:

- Reconcile all existing accounts

- Categorize historical transactions consistently

- Archive outdated client information

- Document your current processes

Leverage Automation Gradually

Don’t try to automate everything immediately. Start with:

- Bank feed connections

- Recurring invoice templates

- Basic expense rules

- Simple report scheduling

Maintain Security Standards

Protect your financial data:

- Enable two-factor authentication

- Use role-based access controls

- Regular data backups

- Audit user access quarterly

Common Pitfalls to Avoid

Choosing Based on Price Alone

A cheaper option might cost more in the long run if it lacks essential features or scalability. Consider total value, not just monthly fees.

Ignoring Integration Needs

Disconnected systems create data silos and manual work. Prioritize platforms that connect with your existing tools.

Underestimating Learning Curves

Even “simple” software requires adjustment. Budget time for training and initial setup—it’s an investment that pays dividends.

Neglecting Mobile Capabilities

In today’s always-on business environment, desktop-only solutions limit your effectiveness and responsiveness.

Looking Ahead: The Future of Entrepreneurial Accounting

AI-Driven Intelligence

Modern accounting software harnesses the power of AI to streamline labor-intensive processes, enabling businesses to operate more effectively and focus on strategic priorities. Expect even smarter automation, predictive analytics, and personalized financial insights.

Embedded Financial Services

The line between accounting software and banking continues to blur. Future platforms will likely offer integrated lending, investment management, and advanced treasury services.

Real-Time Collaboration

As remote work becomes permanent, expect enhanced collaborative features, including live financial dashboards, integrated communication, and seamless advisor access.

Conclusion: Your Financial Foundation for Success

Choosing accounting software isn’t just a technical decision—it’s a strategic investment in your entrepreneurial future. The right platform becomes your financial command center, transforming chaos into clarity and data into decisions.

Whether you choose the proven reliability of QuickBooks, the collaborative power of Xero, or the simplicity of FreshBooks, the key is taking action. Every day spent wrestling with spreadsheets is a day not spent growing your business.

Start with a clear assessment of your needs, test thoroughly, and choose boldly. Your future self—and your accountant—will thank you.