│ Republic Review

│ Republic Review

Republic is a private investment platform targeted toward investors seeking high growth potential. They facilitate private investment opportunities across startups, gaming, real estate, and crypto.

This investment platform is an excellent option for those looking to enter the investment market. Keep reading to find out whether Republic is the right fit for you.

Republic – Best for individual investors | The success of Republic has been built off their private deals. Individuals can start investing right away from as little as $10. |

│ Republic Pros and Cons

│ Republic Pros and Cons

Before we get into the nitty-gritty of Republic, let’s look at its main pros and cons. These advantages and disadvantages will give you a better sense of whether this is the platform for you.

Republic Pros

Investment is accessible

Investment is accessible

Thanks to its low investment minimums, Republic is more accessible than other platforms. If you’re over 18, have an ID, and meet the issuer’s requirements, you can start investing with Republic.

Companies are vetted

Companies are vetted

Republic prides itself on its strong company vetting process. Potential companies must pass a three-step process before raising funds on Republic. This process considers the founders, product, mission, track record, business model, social impact, etc.

There are various investment opportunities

There are various investment opportunities

You can invest in an array of different companies. Republic features companies from the arts and entertainment, fashion, media, technology, etc. At the time of writing, there are 92 live investment opportunities.

Republic is very transparent

Republic is very transparent

There is transparency during every step of the investment process. Republic’s website is clear about the risks involved in investment. They even have an entire ‘risk disclosures’ section.

Guidance is available

Guidance is available

Republic is passionate about educating individuals to become the best investors possible. It offers FAQ pages, webcasts, and blogs to arm users with the tools needed for success.

You can automate the investment process.

You can automate the investment process.

The ‘Autopilot’ feature lets investors automate payments to startups that meet specific criteria. Set up recurring payments for startups and adjust your criteria at any time.

You can connect with the Republic community.

You can connect with the Republic community.

Republic has online forums to encourage conversation among investors. There’s also an online channel to allow you to ask questions to the companies you’re investing in.

Republic Cons

There are high fees

There are high fees

There are high fees involved in investing with Republic. They take 6% of the funds raised in cash, plus 2% for Crowd SAFE.

It’s not always easy to collect your funds

It’s not always easy to collect your funds

You can only collect your funds if the company meets or surpasses its funding target. This may take a while and could lock up your investment for a year.

Investments are high risk

Investments are high risk

Like with any investment platform, there’s an element of risk involved. When you invest in startups, there’s a high likelihood that you could lose your entire investment.

| Republic Advantages | Republic Disadvantages |

|---|---|

Why wait? Try Republic Today!

Angel investing was previously only accessible to the wealthiest individuals. However, with Republic, everyone can invest in private startups for a chance to earn a return.

│What is Republic?

│What is Republic?

Republic provides highly vetted investment opportunities across a range of industries. It’s one of the pioneering companies in equity crowdfunding. Over 1 million people have invested over $500,000,000 in over 500 completed deals.

The team behind Republic is diverse and has a lot of expertise in private investing. It was founded by alumni from AngelList and Uber. Thanks to its standout interface, impressive features, and low minimums, Republic has distinguished itself as one of the top Title III funding portals.

│ How Does Republic Work?

│ How Does Republic Work?

The private investment market is typically reserved for institutional and wealthy individuals. However, with Republic, anyone can invest directly in highly-vetted startups, real estate, video games, local businesses, crypto, music, litigation, finance, and more.

To get started with Republic, follow these critical steps:

- Sign up and create your investor profile

- Verify your identity

- Connect a payment method

- Calculate your investment limits

- Review available investment opportunities

- Make your first investment

Users provide capital in exchange for a financial stake in a company, fund or project. Financial interest is bound by an agreement or ‘security’ between you and the issuer.

There are various types of investments on Republic:

- Equity

Equity is a piece of ownership in the company. It’s often offered through a Crowd Stock Purchase Agreement (Crowd SPA).

- Future Equity

Future equity is a financial interest in the company that may provide the right to equity at a future time. The security attached to this investment is the Crowd Simple Agreement for Future Equity (Crowd SAFE)

- Digital Assets

Digital assets are intangible assets created, issued, traded, and stored in a digital format. Examples include cryptocurrencies and crypto tokens.

A Token Debt Payable by Assets (Token DPA) is a loan payable in tokens or cash in the future. A Token Purchase Agreement (TPA) is a contract entitling you to future tokens.

- Debt

Investors can lend the company money and receive their investment back with interest. Crowd Term Notes may provide scheduled payments based on the amount lent to the issuer and the agreed-upon interest rate.

- Revenue Share

Revenue shares are when you share in profits without ownership and earn passive income. Crowd Revenue Notes may provide payments based on an issuer’s revenue flow up to a certain maximum.

│ Republic Features

│ Republic Features

Republic has lots of great functions for its users to enjoy. Below we will outline some of the most significant.

Republic App

Republic App

In 2020, Republic released its iOS application. This makes investing even easier; users can monitor their investments on the go via their mobile phones. This app focuses on UX and UI and is an excellent addition to Republic’s web platform.

Autopilot Function

Autopilot Function

The autopilot function allows investors to build a diversified startup portfolio hands-free. You can schedule payments to startups for simplified investing. This is ideal for those with multiple investments and means that investing can run in the background.

Accredited Deal Room

Accredited Deal Room

The Accredited Deal Room is available to accredited investors. You can only become accredited if you have a net worth of over $1m, an annual salary of $200K, or a joint salary of $300K. You can co-invest with venture capital firms, family offices, and high-net-worth individuals for the chance of a higher return.

Featured Investors

Featured Investors

Republic’s Featured Investors tool allows you to attach yourself to experts, friends, or notable figures who are experienced investors. You can follow users and receive notifications when they make a public investment.

Screening Process

Screening Process

Republic scrutinizes every startup application to ensure its legitimacy. The selection process involves three stages: the initial screening, due diligence, and final decision. Republic claims that only 5% of applicants successfully get featured on Republic’s site.

Why We Need to Use Republic

Republic Can Work For You!

The Republic platform caters to all types of investors who want to buy into private investment deals. Even if you aren’t a startup investing expert, its Autopilot and Featured Investors offerings make it simple.

│ Who Should Use Republic?

│ Who Should Use Republic?

Republic is generally available for anyone 18 years or older. Each issuer will have its own unique requirements regarding minimum investment, income, employment status, etc.

Individual investors and accredited investors can invest with Republic, allowing entrepreneurs to reap the financial benefits.

Individual Investors

Individual Investors

Individual investors make up a large part of Republic’s investing community. Non-accredited investors can take part in most investment opportunities. However, there are limitations on how much they can invest.

Accredited Investors

Accredited Investors

If your network and income grant you accreditation status, you may qualify for accredited-only deals. These deals have a $10,000 minimum investment and allow you to co-invest with VCs, family offices, and high-net-worth individuals.

International Investors

International Investors

Republic accepts international investors, but issuers may have their own restrictions. If you’re outside the US, you must observe the laws and determine whether you need to undergo additional legal formalities.

Entrepreneurs

Entrepreneurs

Entrepreneurs can seek funding from a broad base of diverse investors. Companies can build a loyal base of investors thanks to Republic’s private investment network.

| Usage |

|---|

Use Republic to find a Unicorn!

Republic gives you access to potential unicorns. Unicorns are startups with a $1bn+ valuation. If you’re lucky enough to find and invest in one at an early stage, your return could be very significant.

│ Republic Time and Cost

│ Republic Time and Cost

Creating an investor profile only takes a minute; from there, you can browse the investment opportunities and get started. Each startup campaign will run for a set amount of time, regardless of whether it reaches its funding goal.

Republic’s services are generally free, and investments can start from as little as $10. However, it’s worth noting that Republic takes a cut of 6% from the total amount raised.

│ Republic Usability

│ Republic Usability

A significant advantage of Republic is its ease of use. You can create an account and begin browsing investment opportunities in minutes. The interface of Republics app and website is sleek and easy to navigate.

Republic accepts multiple payment methods, making the user experience more seamless. They accept credit and debit cards, ACH transfers, and wire transfers. Some issuers even accept crypto payments for increased flexibility.

There are plenty of helpful pages explaining how Republic works, investment limits, deal terms, risks, restrictions, etc. Republic prides itself on its transparency and doesn’t deny the significant financial risks involved in investment.

│Republic Pricing – What Does It Cost?

│Republic Pricing – What Does It Cost?

| Making an investment when using Republic is free for investors. There is absolutely nothing for you to pay. Companies only pay if they successfully reach their funding goal – 6% of the total funds raised in cash and 2% as a Crowd SAFE. |

| Trial | No! | |

| Investors | – | FREE |

| Companies reaching funding goal | Starting from | 6% fee of total funds2% as a Crowd SAFE |

Discover Republic today!

Find out how Republic can help you make an investment! Contact a Republic specialist now!

│ How Can Republic Help My Business?

│ How Can Republic Help My Business?

If you’re an entrepreneur, Republic is a great platform to raise capital. You can raise up to $5 million, increase product sales, grow your brand and engage your community. Companies choose Republic over other platforms because of its strong network of investors, loyal partners, and trusted brand.

By connecting with Republic investors, you can access their network of connections and expertise. Investors bring in far more than just money; companies can enjoy long-lasting marketing effects with Republic crowdfunding.

Republic offers many significant benefits that can help your business to raise capital:

Pitch and marketing knowledge

Pitch and marketing knowledge

Republic has an array of valuable resources for entrepreneurs looking to pitch and market their startups. They also host public and private events, which can provide you with invaluable knowledge about crowd investing and raising capital.

Access to a global network

Access to a global network

Republic is continuously building its active and collaborative global investing community. They form strategic partnerships to support founders and investors alike. Entrepreneurs can partner with institutions, VCs, accelerators, and companies with a shared passion for helping business founders.

Community Engagement

Community Engagement

You can turn your investors into brand ambassadors and access their continued support throughout your business journey. Investors can be a substantial source of income, knowledge, support, and publicity.

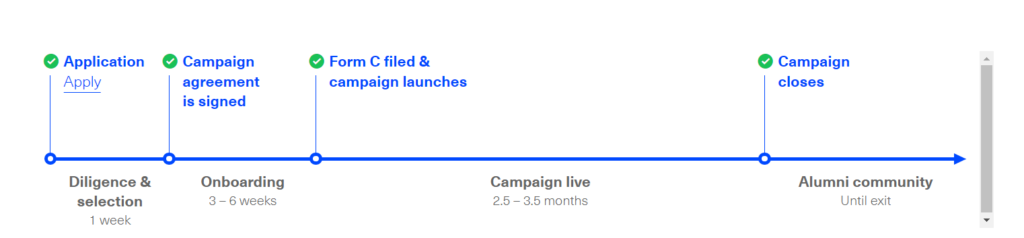

Simple Process

Simple Process

Republic has created a startup-friendly process that makes running an investment campaign easy and affordable. It comprises three main stages: the selection process, onboarding, and the campaign. When your campaign closes, join the Alumni community and receive continued support and guidance.

| Points to Note |

|---|

│ Republic Use Cases

│ Republic Use Cases

Below we will look at some of Republic’s success stories.

Sapient

Sapient

Sapient is a B2B business that created a unique plug load management and analytics system. After just 90 days on Republic, they raised $1,070,000 from 1889 investors. They also garnered over 20 inbound customer leads and secured over $750,000 of customer contracts thanks to their campaign.

Neopenda

Neopenda

Neopenda is a medical device startup that gives patients in low-resource settings access to high-quality care. They raised $270,206 from 849 investors in 2019. They also received $150,000 in follow-on investment from established angel investors.

Are.na

Are.na

Are.na is a social media and design company that raised $288,184 in 2018. Thanks to their campaign, their membership increased by 60% to over 40,000. They also received favorable coverage in ARTnews, Artsy, Fast Company Design, and Garage.

│ Republic Support

│ Republic Support

Republic offers a great deal of support for investors and founders. As a result, Republic has achieved a superb Genius score!

Educational webinars, blogs, and events are available to advise individuals on making wise investment and business decisions.

You can also contact Republic on social media or via email. Investors should contact [email protected] whilst issuers can contact Republic at [email protected]. For all general enquiries, reach Republic support at [email protected].

| Republic Support |

|---|

| Republic Alternative – SeedInvest |

| SeedInvest offers startup investment opportunities for non-accredited and accredited investors. They allow you to invest in and fund your favorite companies before they go public. Their interface is straightforward, and they’re a top-rated investment platform. |

| Comparing Republic to SeedInvest |

| Republic and SeedInvest are both marketed toward startups looking to raise funds online. They both undergo a thorough vetting process and offer automated investing tools. However, Republic has far lower minimums and a greater range of investment opportunities. |

│ Conclusion

│ Conclusion

Republic opens the door for anyone to participate in high-level investing. You can invest in a variety of companies at varying levels of progress. The Republic community comprises over 1.5 million users across 100 countries, a testament to its enormous success.

This investment platform is passionate about empowering individuals through education and access to unique investment opportunities. They allow users to research companies and find an option that can earn them some serious cash. They encourage their users to find companies that truly speak to them so they can invest in the future they believe in.

Republic is also a fantastic option for entrepreneurs looking to raise capital for their business venture. Joining the Republic community gives you access to a network of investors who can provide funding, support, and publicity. There are lots of resources to increase the likelihood of campaign success, and founders can access the benefits of Republic even after their campaign has ended.

Try Republic Now!

Republic has built an incredible community since its creation in 2016. Its network of investors, founders, and partners makes it a successful investment platform.

Don’t hesitate. Join the Republic community now!

Frequently Asked Questions (FAQ)

Methodology

- Who?

We are SaaS experts: Our specialists constantly seek the most relevant information to help support your SaaS business. - Why?

We are passionate about users accessing fair SaaS pricing: We offer up-to-date pricing data, reviews, new tools, blogs and research to help you make informed SaaS pricing decisions. - How?

With accurate information: Our website manager tests each software to add a Genius Score using our rating methodology to each product. Our editorial team fact-check every piece of content we publish, and we use first-hand testing, value metrics and leading market data.