Introduction

Making Tax Digital (MTD) for VAT requires all VAT-registered businesses to keep digital records and use MTD-compatible software to submit VAT returns electronically. Since April 2022, all VAT registered businesses must comply with MTD for VAT irrespective of their turnover, making the choice of appropriate software crucial for compliance and business efficiency.

This comprehensive guide examines the leading MTD-compatible software solutions, with particular focus on established providers like Sage, to help businesses make informed decisions about their VAT management systems.

Overview of Best Making Tax Digital Software

| Platform | Starting Price | Free Trial/Plan | Action |

|---|---|---|---|

| Sage (HMRC Recognised, BEST MTD software rated by Techradar) | Tiered pricing | Free trial available | Claim Free Trial |

| Xero | £15/month | 30-day free trial | Start Free Trial |

| QuickBooks | £14/month | 30-day free trial | Try QuickBooks |

| FreeAgent | Free* | Free for bank customers | Get Started |

| Zoho Books | Free tier available | Free plan available | Start Free |

Understanding Making Tax Digital for VAT

What is Making Tax Digital?

Making Tax Digital hinges on three fundamental components: digital record-keeping, compatible VAT software, and regular tax updates. The initiative was designed to simplify VAT processes, increase productivity, and reduce errors in tax submissions.

Current Requirements

Digital records must include VAT on goods and services sold and purchased, show the time and value of each supply excluding VAT, and adjustments to VAT returns must be recorded. Businesses must maintain these records using compatible software or spreadsheets linked to HMRC systems.

Key Compliance Elements

Digital Record Keeping: A requirement to keep business records in a digital format, incorporating digital links where necessary.

API-Enabled Submissions: A requirement to file the VAT return using API (application programming interface) enabled software.

Quarterly Submissions: Businesses must continue submitting VAT returns at their existing frequency (monthly, quarterly, or annually) but through digital channels only.

Featured Solution: Sage MTD VAT Software

Why Choose Sage for MTD Compliance

Sage offers MTD-compatible and HMRC-recognised accounting software that allows businesses to submit VAT returns directly to HMRC. As one of the UK’s most established accounting software providers, Sage has developed comprehensive solutions that address the full spectrum of MTD requirements.

Sage MTD Features

Automated VAT Calculations: Sage calculates VAT automatically and provides document timelines to track invoice stages.

Direct HMRC Submission: Submit VAT returns directly to HMRC with just a click of a button through password-protected login completion.

Multiple VAT Schemes: Support for standard, cash accounting, and flat rate schemes with automatic calculations.

Real-time Collaboration: Share data with authorised accountants in real-time for VAT return verification.

Comprehensive Reporting: Monthly snapshots of current VAT positions and records of previous submissions.

Sage Pricing Structure

Sage offers tiered pricing to accommodate different business sizes:

- Start Plan: Basic accounting features

- Standard Plan: Includes VAT submissions, cash flow management, and multi-user access

- Plus Plan: Advanced inventory tracking, budgeting, and multi-currency support

| Pricing Plan | Annual | Monthly |

|---|---|---|

| Free Tier | Yes | Yes |

| Accounting Start | £216 | £18 |

| Accounting Standard | £468 | £39 |

| Accounting Plus | £708 | £59 |

Additional payroll functionality starts at £10.00 per month excluding VAT for 5 employees, with options to add up to 150 employees.

Top Alternative MTD Software Solutions

Xero

Xero is one of the most popular MTD software solutions in the UK, trusted by thousands of small businesses and accountants for handling VAT and income tax submissions.

Key Features:

- Automatic VAT calculations and returns submission via Making Tax Digital compliance

- Real-time bank feeds to streamline reconciliation

- Over 1,000 integrations with business tools

Pricing: Starting from £15 per month

Best For: Businesses that value user-friendly interfaces and extensive integrations

QuickBooks

QuickBooks offers packages specifically tailored for small businesses and the self-employed, as well as accountants and bookkeepers.

Key Features:

- Easy tax-management software with VAT checking and direct return submission to HMRC

- Tools for invoicing, expense tracking, and real-time tax estimates

- Can be used without signing up for a contract and is fully Making Tax Digital ready

Pricing: Starting from £14 per month

Best For: Small-to-mid-sized businesses looking for rich integrations.

FreeAgent

FreeAgent offers auto-generated VAT returns and is particularly beneficial for businesses banking with NatWest, Royal Bank of Scotland, or Ulster Bank NI.

Key Features:

- Built-in prompts and reminders that keep VAT submissions on track

- Links directly to HMRC for VAT submissions

- Free for certain bank account holders

Best For: Simple, straightforward VAT management with minimal complexity

Zoho Books

The UK edition is now fully MTD compliant, making it a cost-effective option for various business users from sole traders to larger limited companies.

Key Features:

- Incorporates VAT duty on foreign trade into accounting

- Free tier available

- Integration with other Zoho products

Best For: Businesses requiring international trade VAT management

Business Requirements for MTD Compliance

Mandatory Compliance Criteria

Mandatory compliance is required for businesses with a taxable turnover in excess of £85,000 (updated to £90,000 in 2025). However, all VAT registered businesses must now comply regardless of turnover.

Technical Requirements

Software Specifications: Software products must submit fraud prevention header data required by law and retrieve VAT obligations using the VAT (MTD) API.

Digital Links: Businesses must utilise digital links to interconnect disparate components of their records, such as invoices and receipts, to guarantee accuracy and completeness.

Record Retention: Records must be kept from VAT registration and retained for at least 6 years, or 10 years for certain schemes.

Implementation Timeline

For businesses new to MTD:

- Assuming you are below the VAT threshold and are a voluntary filer, you need to start adhering to Making Tax Digital from the first day of your first VAT period that began on or after 1 April 2022

- Since 1 November 2022, quarterly or monthly VAT returns can no longer be filed using existing VAT online accounts

Software Selection Criteria

Essential Features to Consider

HMRC Recognition: Ensure the software appears on HMRC’s official list of compatible providers.

Direct Submission Capability: The software must enable you to file the VAT return digitally with HMRC, either directly from within the software or by using bridging software.

Digital Record Management: Comprehensive storage and organisation of VAT-related transactions and documents.

Automated Calculations: Reduced manual input and calculation errors.

Multi-user Access: Collaboration features for accountants and team members.

Bridging Software Options

For businesses using spreadsheets: If you use spreadsheets, you will need to purchase bridging software which will link your spreadsheet to HMRC’s systems and enable the VAT return to be filed.

MyTaxDigital is a no-frills MTD software built for businesses who want a simple, HMRC-recognised way to submit VAT returns, especially useful for those who prefer to keep records in spreadsheets.

Industry-Specific Considerations

Small Businesses and Sole Traders

Recommended Solutions:

- KashFlow offers entry-level functionality ideal for micro-businesses and sole traders

- QuickFile is budget-conscious with strong capabilities for bank reconciliation and invoice management

Growing SMEs

Scalability Requirements:

- Sage is the most scalable option, suitable for businesses that anticipate significant growth or have complex accounting structures

- Xero is ideal for startups requiring a simple, MTD-compliant cloud solution

Accountancy Practices

Multi-client Management:

- Sage remains a powerhouse with robust reporting tools valued by accountants managing clients with varying complexity

- Xero continues to lead among cloud accounting tools with strong accountant portal and real-time collaboration

Implementation Best Practices

Getting Started with MTD

Step 1: Software Selection

- Choose MTD-compatible software like Sage and visit Settings > VAT Details to check information is correct

- Ensure the chosen solution meets current and anticipated future needs

Step 2: Data Migration

- Start keeping digital records for current and future VAT returns

- Establish digital links between different components of financial records

Step 3: Testing and Training

- Conduct test submissions before live implementation

- Train staff on new processes and software features

Ongoing Compliance Management

Regular Monitoring: VAT and future MTD users face a 3% charge if tax is 15 days late, rising to 6% after 30 days, plus an annual 10% for amounts unpaid beyond 31 days.

Software Updates: Ensure software remains current with HMRC requirements and regulatory changes.

Professional Support: Consider working with qualified accountants or bookkeepers familiar with MTD requirements.

Frequently Asked Questions

What happens if I don’t comply with MTD for VAT?

HMRC can charge as much as 30% of the extra VAT as a penalty for careless mistakes, and up to 100% for deliberate errors within VAT returns. Additional penalties apply for late submissions.

Can I still use spreadsheets for VAT records?

Yes, but only with bridging software. The combination of the spreadsheet and the bridging software will constitute the ‘functional compatible software’.

Do I need to register separately for MTD for VAT?

HMRC will sign up all new VAT registered businesses to Making Tax Digital for VAT automatically unless they are already exempt or have applied for exemption.

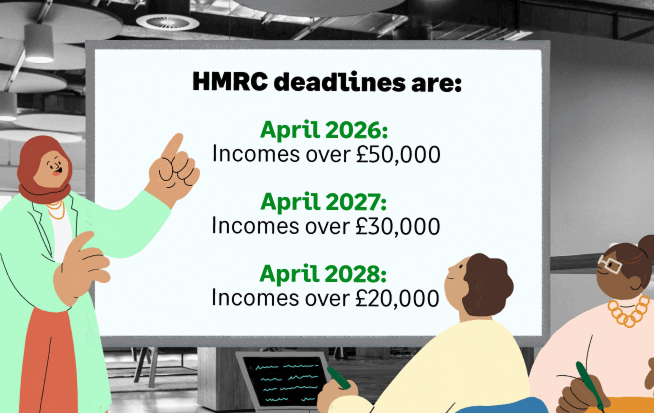

What about MTD for Income Tax?

From April 2026, if you have an income of over £50,000 annually from self-employment or property rental, you’ll need to use MTD compatible software for income tax as well.

Is free MTD software available?

Yes, there is free MTD-compliant software available including VitalTax for use with Microsoft Excel and the Zoho Books free plan.

How do I choose between different software options?

Start by thinking about what you actually need – if you just want to file VAT returns from a spreadsheet, a free bridging tool might be enough. Consider your business size, complexity, growth plans, and integration requirements.

Conclusion

Making Tax Digital for VAT has fundamentally changed how UK businesses manage their tax obligations. The benefits include accuracy through reduced manual errors, real-time insights for better decision-making, and convenience through faster digital submissions.

Sage stands out as a comprehensive solution offering robust features, scalability, and extensive support options, making it particularly suitable for businesses with complex requirements or growth ambitions. However, the diverse range of MTD-compatible software ensures that businesses of all sizes can find appropriate solutions, from simple bridging tools for spreadsheet users to comprehensive enterprise platforms.

The key to successful MTD implementation lies in selecting software that aligns with your current needs while providing room for future growth, ensuring ongoing compliance with HMRC requirements, and maintaining accurate, timely VAT submissions. With proper planning and the right software choice, businesses can not only achieve compliance but also gain improved financial visibility and operational efficiency.